Leading Benefits of Debt Consolidation for Handling Your Funds: More Discussion Posted Here

Leading Benefits of Debt Consolidation for Handling Your Funds: More Discussion Posted Here

Blog Article

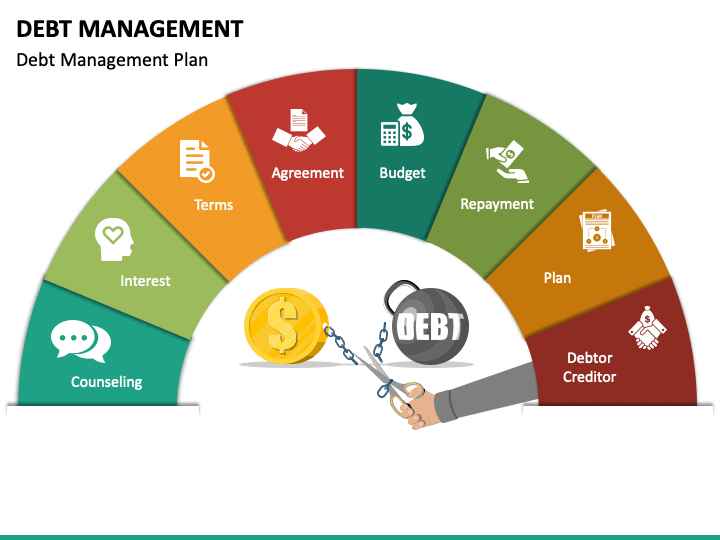

The Critical Function of Experience in Applying a Reliable Debt Management Plan

Significance of Expert Assistance

The significance of expert advice in browsing the complexities of debt monitoring can not be overemphasized. Professional assistance plays a critical role in developing and executing an efficient debt management plan. Skilled monetary experts bring a wide range of understanding and experience to the table, allowing individuals and organizations to make educated decisions regarding their economic responsibilities.

Expert advice aids in examining the present monetary situation precisely. By evaluating earnings, costs, and debt levels, specialists can tailor a financial debt administration strategy that lines up with the client's monetary capabilities and goals (More Discussion Posted Here). Moreover, economists can bargain with lenders on part of their clients, potentially safeguarding reduced rates of interest, extensive payment terms, or also debt settlements

Additionally, expert support infuses self-control and responsibility in the debt management process. Advisors provide ongoing assistance and surveillance, making certain that the plan remains on track and modifications are made as necessary. With skilled guidance, individuals and companies can navigate the complexities of financial obligation monitoring with confidence and clearness, eventually paving the method in the direction of monetary security and liberty.

Recognizing Financial Obligation Alleviation Options

A thorough expedition of viable financial debt relief choices is essential for businesses and individuals looking for to minimize their financial burdens properly. When faced with overwhelming financial debt, understanding the various financial obligation relief alternatives available is important in making informed choices. One usual technique is financial debt consolidation, which involves combining several financial obligations into a single funding with potentially reduced rate of interest. Debt settlement is an additional choice where settlements with lenders lead to a lowered total financial debt quantity. For those dealing with severe financial difficulty, insolvency might be considered as a last hope to eliminate or reorganize financial debts under court supervision. Each of these options has its ramifications on credit rating, monetary security, and long-term repercussions, making it critical to thoroughly evaluate the pros and disadvantages before proceeding. Seeking suggestions from monetary professionals or credit therapists can give valuable insights into which financial obligation relief option straightens finest with one's special economic circumstance and goals. More Discussion Posted Here. Ultimately, a well-informed decision regarding financial obligation relief options can lead the way towards a much more stable and protected monetary future.

Bargaining With Creditors Effectively

Discovering reliable arrangement strategies with financial institutions is vital for people and businesses web link browsing their financial debt relief alternatives. When working out with financial institutions, it is crucial to approach the conversation with a clear understanding of your economic scenario, including your revenue, costs, and the amount of debt owed. Transparency is key throughout these discussions, as it helps construct depend on and reputation with lenders.

One reliable technique is to propose a structured settlement plan that is sensible and manageable based upon your current economic abilities. This demonstrates your commitment to fulfilling your commitments while likewise recognizing the obstacles you may be encountering. Furthermore, supplying a round figure negotiation or requesting a reduced rates of interest can likewise be feasible settlement strategies.

Furthermore, staying calmness, respectful, and specialist throughout the settlement process can considerably enhance the chance of getting to an equally valuable contract. It is vital to record all communication with creditors, including agreements reached, to stay clear of any type of misunderstandings in the future. By using these arrangement methods, individuals and businesses can work in the direction of fixing their financial obligations successfully and responsibly.

Custom-made Financial Obligation Monitoring Strategies

In creating efficient financial debt administration strategies, tailoring the approach to match the special financial situations of individuals and organizations is vital. Customized financial obligation management approaches include a personalized assessment of the borrower's economic situation, considering elements such as earnings, expenses, arrearages, and future economic goals. By tailoring the financial obligation monitoring strategy, experts can produce a tailored roadmap that addresses the certain needs and obstacles of each customer.

One trick element of customized financial obligation administration methods is the growth of realistic and possible settlement strategies. find more information These strategies are structured based on the individual's or service's economic capacities, guaranteeing that they can fulfill their obligations without causing unnecessary economic strain. Furthermore, customized techniques might entail bargaining with financial institutions to safeguard much more favorable terms, such as lower interest rates or expanded settlement durations, even more easing the burden on the borrower.

Monitoring and Readjusting the Plan

Effective debt administration specialists comprehend the relevance of continuously monitoring and adjusting the customized repayment strategy to guarantee its effectiveness and alignment with the customer's economic circumstances. Tracking involves routinely tracking the progression of the financial obligation monitoring strategy, reviewing the customer's adherence to the agreed-upon repayment timetable, and recognizing any kind of discrepancies or barriers that may emerge. By consistently keeping track of the plan, specialists can proactively address concerns, offer required assistance, and protect against prospective setbacks.

Normal communication between the financial debt administration specialist and the customer is essential throughout the monitoring and readjusting procedure. Open up discussion permits transparent discussions concerning any kind of difficulties or changes, enabling both events to interact effectively towards the client's monetary goals.

Conclusion

In conclusion, knowledge plays a critical function in implementing a reliable financial obligation monitoring plan. Custom-made financial obligation monitoring techniques are crucial for developing a plan tailored to each person's requirements.

By analyzing earnings, costs, and financial debt degrees, professionals can tailor a financial obligation administration strategy that aligns with the customer's financial capacities and goals. When faced with frustrating debt, recognizing the different financial debt relief choices available is essential in making notified decisions. One usual technique is financial obligation loan consolidation, which involves incorporating numerous financial obligations into a solitary finance with potentially reduced rate of interest prices. Financial debt negotiation is one more option where negotiations with financial institutions result in a lowered overall financial debt amount. Customized financial debt administration techniques involve a personalized analysis of the debtor's financial scenario, taking into account factors such as revenue, expenditures, outstanding financial debts, this hyperlink and future economic goals.

Report this page